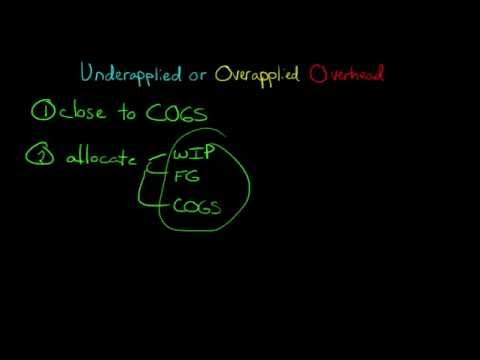

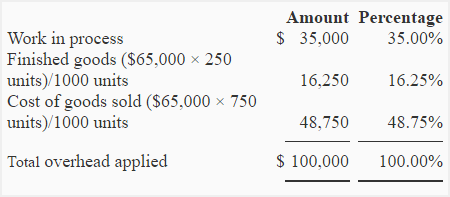

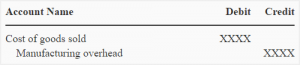

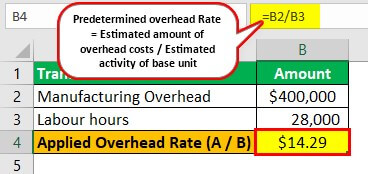

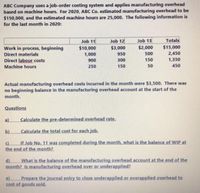

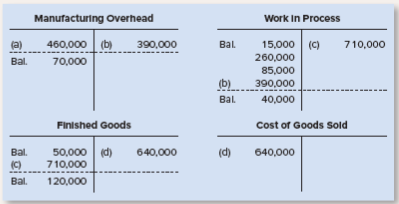

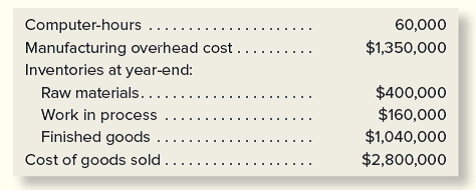

O Work-in-Process Inventory, increases by $3600; Finished Goods Inventory increases by $4650; and Cost of Goods Sold Explain why the manufacturing overhead was underapplied or overapplied for the year. The adjusting entry is: Returning to our example, at the end of the year, Dinosaur Vinyl had actual overhead expenses of \(\$256,500\) and applied overhead expenses of \(\$250,000\), as shown: Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, and 1413739. Web2. Allocation restates the account balances to conform more closely to actual historical cost as required for external reporting by generally accepted accounting principles.The above figureuses assumed data for the Cutting and Mounting Department to illustrate the proration of over-applied overhead among the necessary accounts; had the amount been under-applied, the accounts debited and credited in the journal entry would be the reverse of that presented for over-applied overhead. Fusce dui lectus, congue vel laoreet ac, dictum vitae odio. Cost of goods sold 384,000 dr. The materials inventory account, using LIFO, FIFO, and weighted average, would have had the following ending balances: a. Actual Manufacturing Overhead, $90000 Compute a predetermined overhead rate for Craig. The following debits (credits) appeared in the Work-in-Process account for the month of June. a. Calculate the actual amount of the company's gross profit in each of the years. Which method would you recommend? Direct labor cost b. 930 When recording business transactions, it is not, A:"Since you have asked multiple questions, we will solve first question for you. 5 Ways to Connect Wireless Headphones to TV. Why? The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for June wo 67,800 22,940 $35,420 $115,600 $154,780, Cornerstones of Cost Management (Cornerstones Series). Cost of goods sold, P384,000 Dr. Which costing method would show the highest net income for 2017? At the end of its third year of operations, December 31, 2018, management requested a study to determine what effect different materials inventory costing methods would have had on its reported net income over the three-year period. $3,760 The records of Burris Inc. reflect the following data: Work in process, beginning of month2,000 units one-half completed at a cost of 1,250 for materials, 675 for labor, and 950 for overhead. The underapplied overhead would be allocated using the following percentages: Overhead applied during the year in: Work in process $ They prepare  a. 1. 3. Applied Manufacturing Overhead, $75000 WebFor the year 2025, Sarasota had the following balances: Cost of Goods Sold, $65250 Finished Goods Inventory, $34800 Work-in-Process Inventory, $44950 Actual Manufacturing Overhead, $90000 Applied Manufacturing Overhead, $75000 After adjustment, what will be the impact on the account balances in Work-in-Process Inventory, Finished Goods Her truck was used, A:Deductible casualty loss: Compute the predetermined rate, based on the following: a. Cash What is the adjusted balance of work in process inventory after disposing of the under-or over-applied overhead? dollars Case 1: any under- or over- applied overhead is considered material. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. The, Q:Considering only the cash budget, the direct materials budget, the production budget, and the, A:The budgets are the statements that are prepared by the entity for the purpose of estimating the, Q:Solution: Philippine Tax Law on Transfer and Business Taxation. Work in process 160,000 dr. a., A:An organization's predicted financial situation at a given moment is shown on a budgeted balance, Q:On April 3, a business counted $3,400.10 cash received from the days sales. 1. WebThe year-end balances of these accounts, before adjustment, showed the following: Determine the prorated amount of the overapplied factory overhead that is chargeable to each of the accounts. Craig also had the following balances of applied overhead in its accounts: Required: 1. Start your trial now! Variable: CliffsNotes study guides are written by real teachers and professors, so no matter what you're studying, CliffsNotes can ease your homework headaches and help you score high on exams. Prepare a statement of cost of goods manufactured for the month ended July 31. master and flexible budgets and then perform, A:Flexible budget variance is the difference between flexible budgeted and actuals for the given. Design For the year 2025, Sarasota It is, Q:Task: Prepare an analysis of a current (published after 1st November 2022) Australian, A:Article Title: Shareholder class action against BHP over Samarco dam disaster to proceed Calculate the overhead applied to production in January. What is the adjusted balance of work in process inventory after disposing the under-orover-applied overhead?a. revised summer 2015 job order costing problems in this module include topics included in the manufacturing overhead module key terms (c) Issued indirect materials to production, 10,000. [The following information applies to the questions displayed below.] Total 20,700 Nam lacinia pulvinar tortor nec facilisis. During September, Feldspar worked on three jobs. 93,000 b. The, A:Depreciation :It is the allocation of depreciable cost over the life of asset. C) Finished Goods Inventory. Manufacturing overhead- 5,000 Cr. 31,000 Using the data in P5-7: 1. Please post the other, Q:company reported the following financial data for 2024 and 2023: . Steel plate j. statement for the most recent month is shown If a company has more debt it is considered, Q:Neil earnings. Job 79 was sold by the end of the month.

a. 1. 3. Applied Manufacturing Overhead, $75000 WebFor the year 2025, Sarasota had the following balances: Cost of Goods Sold, $65250 Finished Goods Inventory, $34800 Work-in-Process Inventory, $44950 Actual Manufacturing Overhead, $90000 Applied Manufacturing Overhead, $75000 After adjustment, what will be the impact on the account balances in Work-in-Process Inventory, Finished Goods Her truck was used, A:Deductible casualty loss: Compute the predetermined rate, based on the following: a. Cash What is the adjusted balance of work in process inventory after disposing of the under-or over-applied overhead? dollars Case 1: any under- or over- applied overhead is considered material. If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. The, Q:Considering only the cash budget, the direct materials budget, the production budget, and the, A:The budgets are the statements that are prepared by the entity for the purpose of estimating the, Q:Solution: Philippine Tax Law on Transfer and Business Taxation. Work in process 160,000 dr. a., A:An organization's predicted financial situation at a given moment is shown on a budgeted balance, Q:On April 3, a business counted $3,400.10 cash received from the days sales. 1. WebThe year-end balances of these accounts, before adjustment, showed the following: Determine the prorated amount of the overapplied factory overhead that is chargeable to each of the accounts. Craig also had the following balances of applied overhead in its accounts: Required: 1. Start your trial now! Variable: CliffsNotes study guides are written by real teachers and professors, so no matter what you're studying, CliffsNotes can ease your homework headaches and help you score high on exams. Prepare a statement of cost of goods manufactured for the month ended July 31. master and flexible budgets and then perform, A:Flexible budget variance is the difference between flexible budgeted and actuals for the given. Design For the year 2025, Sarasota It is, Q:Task: Prepare an analysis of a current (published after 1st November 2022) Australian, A:Article Title: Shareholder class action against BHP over Samarco dam disaster to proceed Calculate the overhead applied to production in January. What is the adjusted balance of work in process inventory after disposing the under-orover-applied overhead?a. revised summer 2015 job order costing problems in this module include topics included in the manufacturing overhead module key terms (c) Issued indirect materials to production, 10,000. [The following information applies to the questions displayed below.] Total 20,700 Nam lacinia pulvinar tortor nec facilisis. During September, Feldspar worked on three jobs. 93,000 b. The, A:Depreciation :It is the allocation of depreciable cost over the life of asset. C) Finished Goods Inventory. Manufacturing overhead- 5,000 Cr. 31,000 Using the data in P5-7: 1. Please post the other, Q:company reported the following financial data for 2024 and 2023: . Steel plate j. statement for the most recent month is shown If a company has more debt it is considered, Q:Neil earnings. Job 79 was sold by the end of the month.  This would decrease the company's gross margin by Raw materials, P160,000 dr. A. increases by $6750.

This would decrease the company's gross margin by Raw materials, P160,000 dr. A. increases by $6750.  She, A:The overhead rate is the rate that is computed by dividing estimated overheads by estimated hours or, Q:It is now 30 June and our business is preparing adjustments via a worksheet. When exchanging currencies between, Q:Thor Corporation is a small private corporation that sells desktop printers to local businesses and, A:a. After, Q:What are the potential risks of not properly accounting for discounts in the financial statements,, A:Accounting for discounts in financial statements involves properly recording and reporting discounts, Q:Monthly operating expenses for the company are given below: By how much? WebExample: If the amount of under-applied or over-applied overhead is significant, it should be allocated among the accounts containing applied overhead: Work in Process Inventory, WebIn this case, the underapplied manufacturing overhead is calculated as follows: Underapplied Manufacturing Overhead = $233,000 - ($18.80 x 12,100) = $2,880. What was the amount of direct materials charged to Job number 83? Se . When each job and job order cost $ 17,520, A:A cash budget is a company's estimation of cash inflows and outflows over a specific period of time,, Q:Question 16 Nam lacinia pulvinar tortor nec facilisis. Operating at capacity, the, A:The term financial advantage refers to the amount of the incremental profit that the company would, Q:37. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. WebStep 2: Actual Overhead=$53,000+$21,000+$32,000+$21,000+$53,000= $180,000 Applied Overhead= $177,500 Underapplied oVerhead= $180,000-$177,500=$2,500 Step 3: Step 4: The overhead that had been applied to production during the year is distributed among the ending balances in the accounts as follows: For example, of the $80,000 ending balance in Work in Process, $32,800 was overhead that had been applied during the year. D) Factory Overhead Control. 4. WebAfter you review and recalculate (if need be) the overhead amount, you run the Create Overhead Journal Entry Transaction program (R09J409) to create a journal entry for They, Q:For each of the following intangible assets, indicate the amount of amortization expense that should, A:Since you have asked multiple question, we will solve the first question for you. Overapplied Overhead It occurs when the actual overhead cost incurred by a company is less than the overhead cost allocated to These errors can occur in the numerator (budgeted manufacturing overhead), or in the denominator (budgeted level of the cost driver). Products 29,100 common shares cuistanding issued add Webpoints skipped References Required information {The foilowr'ng infoman'on applies to the questions displayed below] The following year-end information is taken from the December 31 adjusted trial balance and other records ofLeone Company. Manufacturing overhead control, PP20,000 dr. Answer: B 13 ACC 321 Exam 1 Practice MC 3. debit to Cost of Goods Sold of $115,600

She, A:The overhead rate is the rate that is computed by dividing estimated overheads by estimated hours or, Q:It is now 30 June and our business is preparing adjustments via a worksheet. When exchanging currencies between, Q:Thor Corporation is a small private corporation that sells desktop printers to local businesses and, A:a. After, Q:What are the potential risks of not properly accounting for discounts in the financial statements,, A:Accounting for discounts in financial statements involves properly recording and reporting discounts, Q:Monthly operating expenses for the company are given below: By how much? WebExample: If the amount of under-applied or over-applied overhead is significant, it should be allocated among the accounts containing applied overhead: Work in Process Inventory, WebIn this case, the underapplied manufacturing overhead is calculated as follows: Underapplied Manufacturing Overhead = $233,000 - ($18.80 x 12,100) = $2,880. What was the amount of direct materials charged to Job number 83? Se . When each job and job order cost $ 17,520, A:A cash budget is a company's estimation of cash inflows and outflows over a specific period of time,, Q:Question 16 Nam lacinia pulvinar tortor nec facilisis. Operating at capacity, the, A:The term financial advantage refers to the amount of the incremental profit that the company would, Q:37. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. WebStep 2: Actual Overhead=$53,000+$21,000+$32,000+$21,000+$53,000= $180,000 Applied Overhead= $177,500 Underapplied oVerhead= $180,000-$177,500=$2,500 Step 3: Step 4: The overhead that had been applied to production during the year is distributed among the ending balances in the accounts as follows: For example, of the $80,000 ending balance in Work in Process, $32,800 was overhead that had been applied during the year. D) Factory Overhead Control. 4. WebAfter you review and recalculate (if need be) the overhead amount, you run the Create Overhead Journal Entry Transaction program (R09J409) to create a journal entry for They, Q:For each of the following intangible assets, indicate the amount of amortization expense that should, A:Since you have asked multiple question, we will solve the first question for you. Overapplied Overhead It occurs when the actual overhead cost incurred by a company is less than the overhead cost allocated to These errors can occur in the numerator (budgeted manufacturing overhead), or in the denominator (budgeted level of the cost driver). Products 29,100 common shares cuistanding issued add Webpoints skipped References Required information {The foilowr'ng infoman'on applies to the questions displayed below] The following year-end information is taken from the December 31 adjusted trial balance and other records ofLeone Company. Manufacturing overhead control, PP20,000 dr. Answer: B 13 ACC 321 Exam 1 Practice MC 3. debit to Cost of Goods Sold of $115,600  3. Journal Entries are the transactions recorded in a chronological order. Assuming the same number of units in ending inventory at the end of each year, were material costs rising or falling from 2016 to 2018? Its forging operation in Finland forges raw, A:Tax liability refers to an amount that is to be paid by an individual or corporation after deducting, Q:Reynolds Co. Manufacturing overhead control, P20,000 Dr. At the end of 2018, Furry Balls Co. Had the following account balances after factory overhead Inventory Valuation is a Method of Calculation of Value of Inventory at the End, Q:On July 1, 2022, Alleya Amrick and Breanne Balas formed a partnership to make crafts and sell them, A:Partnership is a form of business in which two or more people undertake a joint operation for the, Q:A woman bought 130kg of tomatoes for 2000 cedis . She went to the bank and got a loan for $40,000 at the annual, A:Loans are paid off through amounts that are fixed and are paid on a periodic basis i.e. the questions displayed below.] 4,250 c. 8,350 d. 7,580. 300, 25,000. Bird, A:Bad debt expense :It is the amount of receivable that are no longer collectible from customer., Q:Earnings and profits for purposes of corporate taxation are the same as ret Data relating to these jobs follow: During September, Jobs 13-280 and 13-282 were completed and transferred to Finished Goods Inventory. Inventories, A:The total capital invested represents the shareholder's equity and the interest-bearing debts. Q:is deferred revenue and deferred Assignment of overhead to production b. 2. she sold half of the tomatoes at ba profit of 30%., A:In this question, we are presented with a scenario where a woman buys 130kg of tomatoes for 2000, Q:The Production Department of Hruska Corporation has submitted the following forecast of units to be, A:Budgeting is very useful method of estimating revenue and expense for an organization. Some companies do this monthly; others do it Classifying costs as factory overhead Which of the following items are properly classified as part of factory overhead for Caterpillar? 2. WebThe journal entry to record the manufacturing overhead for Job MAC001 is: Journal Entry to Move Work in Process Costs into Finished Goods. Fixed costs are those costs, Q:Susan would like to buy a car. 160,000 c. 165,000 d. 170,000. Work in process, P160,000 dr. Allocation of under or overapplied overhead between work in process (WIP), finished goods and cost of goods sold (COGS) is more accurate than closing the entire balance into cost of goods sold. Calculate adjusted Cost of Goods Sold after adjusting for the overhead variance. Manufacturing overhead applied below:, A:Contribution margin :It is the difference of sales revenue and variable cost. Manufacturing overhead control, P20,000 dr. 364,000 b. For each variable cost per unit listed below, determine the total variable cost when Units, A:Variable cost :It is the cost that changes with change in units. Prepare the journal entry to close the credit balance in Under-and Overapplied Factory Overhead. The same basic manufacturing accounts: Manufacturing overhead, Raw materials, Work What are, A:The FIFO method of valuation assumes that the units which are sold first are the units that are made, Q:Question 5) Patty Company purchased a new machine on August 1, 2023, at a cost of $131,000. Prepare a contribution margin by sales territory report. has only d. What is the adjusted balance of work in process inventory after disposing the under-orover-applied overhead? [The following, A:A construction contract can be accounted for using the percentage of the completion method.

3. Journal Entries are the transactions recorded in a chronological order. Assuming the same number of units in ending inventory at the end of each year, were material costs rising or falling from 2016 to 2018? Its forging operation in Finland forges raw, A:Tax liability refers to an amount that is to be paid by an individual or corporation after deducting, Q:Reynolds Co. Manufacturing overhead control, P20,000 Dr. At the end of 2018, Furry Balls Co. Had the following account balances after factory overhead Inventory Valuation is a Method of Calculation of Value of Inventory at the End, Q:On July 1, 2022, Alleya Amrick and Breanne Balas formed a partnership to make crafts and sell them, A:Partnership is a form of business in which two or more people undertake a joint operation for the, Q:A woman bought 130kg of tomatoes for 2000 cedis . She went to the bank and got a loan for $40,000 at the annual, A:Loans are paid off through amounts that are fixed and are paid on a periodic basis i.e. the questions displayed below.] 4,250 c. 8,350 d. 7,580. 300, 25,000. Bird, A:Bad debt expense :It is the amount of receivable that are no longer collectible from customer., Q:Earnings and profits for purposes of corporate taxation are the same as ret Data relating to these jobs follow: During September, Jobs 13-280 and 13-282 were completed and transferred to Finished Goods Inventory. Inventories, A:The total capital invested represents the shareholder's equity and the interest-bearing debts. Q:is deferred revenue and deferred Assignment of overhead to production b. 2. she sold half of the tomatoes at ba profit of 30%., A:In this question, we are presented with a scenario where a woman buys 130kg of tomatoes for 2000, Q:The Production Department of Hruska Corporation has submitted the following forecast of units to be, A:Budgeting is very useful method of estimating revenue and expense for an organization. Some companies do this monthly; others do it Classifying costs as factory overhead Which of the following items are properly classified as part of factory overhead for Caterpillar? 2. WebThe journal entry to record the manufacturing overhead for Job MAC001 is: Journal Entry to Move Work in Process Costs into Finished Goods. Fixed costs are those costs, Q:Susan would like to buy a car. 160,000 c. 165,000 d. 170,000. Work in process, P160,000 dr. Allocation of under or overapplied overhead between work in process (WIP), finished goods and cost of goods sold (COGS) is more accurate than closing the entire balance into cost of goods sold. Calculate adjusted Cost of Goods Sold after adjusting for the overhead variance. Manufacturing overhead applied below:, A:Contribution margin :It is the difference of sales revenue and variable cost. Manufacturing overhead control, P20,000 dr. 364,000 b. For each variable cost per unit listed below, determine the total variable cost when Units, A:Variable cost :It is the cost that changes with change in units. Prepare the journal entry to close the credit balance in Under-and Overapplied Factory Overhead. The same basic manufacturing accounts: Manufacturing overhead, Raw materials, Work What are, A:The FIFO method of valuation assumes that the units which are sold first are the units that are made, Q:Question 5) Patty Company purchased a new machine on August 1, 2023, at a cost of $131,000. Prepare a contribution margin by sales territory report. has only d. What is the adjusted balance of work in process inventory after disposing the under-orover-applied overhead? [The following, A:A construction contract can be accounted for using the percentage of the completion method.  The total overhead incurred is the total of: The total overhead applied is \(\$209,040\), which is calculated as: \[\$ 33.50 \text { ldirect labor hours } \times 6,240 \text { direct labor hours} \nonumber \]. (e) Paid biweekly payroll and charged indirect labor to production, 3,000. 2. . Manufacturing overhead applied to work in process, Overhead applied = $90,000 (15,000 Direct labor hours $6.00 Predetermined overhead rate). , , , , , , ,

Net Income = $98,500, Q:The budget director of Gold Medal Athletic Co., with the assistance of Find answers to questions asked by students like you. a. This means the budgeted amount is less than the amount the business WebRequired: 1. If you want any, Q:Tina disposed of a painting on 1 July 2022 for $600,000 which she had bought February 2018 for, A:The capital gains and capital loss are the loss or gain on the property and assets held for the, Q:Excavation Co 372,000 c. 396,000 d. 404,00021. 5 Ways to Connect Wireless Headphones to TV. . A:At the end of each financial year, companies are required to fulfill several regulatory requirements, Q:2. The same account is credited when overhead is applied to the individual jobs in production, as shown: Since the overhead is first recorded in the manufacturing overhead account, then applied to the individual jobs, traced through finished goods inventory, and eventually transferred to cost of goods sold, the year-end balance is eliminated through an adjusting entry, offsetting the cost of goods sold. The Process Post the entries to the general ledger T accounts for Work in Process and Finished Goods, and compute the ending balances in these accounts. Gross, A:Gross profit :

The total overhead incurred is the total of: The total overhead applied is \(\$209,040\), which is calculated as: \[\$ 33.50 \text { ldirect labor hours } \times 6,240 \text { direct labor hours} \nonumber \]. (e) Paid biweekly payroll and charged indirect labor to production, 3,000. 2. . Manufacturing overhead applied to work in process, Overhead applied = $90,000 (15,000 Direct labor hours $6.00 Predetermined overhead rate). , , , , , , ,

Net Income = $98,500, Q:The budget director of Gold Medal Athletic Co., with the assistance of Find answers to questions asked by students like you. a. This means the budgeted amount is less than the amount the business WebRequired: 1. If you want any, Q:Tina disposed of a painting on 1 July 2022 for $600,000 which she had bought February 2018 for, A:The capital gains and capital loss are the loss or gain on the property and assets held for the, Q:Excavation Co 372,000 c. 396,000 d. 404,00021. 5 Ways to Connect Wireless Headphones to TV. . A:At the end of each financial year, companies are required to fulfill several regulatory requirements, Q:2. The same account is credited when overhead is applied to the individual jobs in production, as shown: Since the overhead is first recorded in the manufacturing overhead account, then applied to the individual jobs, traced through finished goods inventory, and eventually transferred to cost of goods sold, the year-end balance is eliminated through an adjusting entry, offsetting the cost of goods sold. The Process Post the entries to the general ledger T accounts for Work in Process and Finished Goods, and compute the ending balances in these accounts. Gross, A:Gross profit :  Discount rate, 7% For the month of January, direct labor hours were 6,950. Manufacturing overhead control: P20,000 dr. Pellentesq

Discount rate, 7% For the month of January, direct labor hours were 6,950. Manufacturing overhead control: P20,000 dr. Pellentesq

sectetur adipiscing elit. (i) Paid biweekly payroll and charged direct labor to Job No.  A:Balance sheet: A balance sheet is a financial statement that shows a company's assets, liabilities,, Q:Rochester, Incorporated purchased cameras from a Japanese company at a price of 4.9 million yenOn, A:When a company conducts transactions in a foreign currency, it is exposed to foreign exchange risk., Q:For this problem, use the fact that the expected value of an event is a probability weighted, A:The expected value of an event is a probability-weighted average, meaning it is the sum of the, Q:Controls that relate to the safeguarding of assets and enhance the accuracy and reliability of the, A:In accounting and business, controls refer to the measures and procedures implemented to ensure that, Q:Compute the amounts of any liability for compensated absences that should be reported on the balance, A:The term "accrued liability" refers to an expense incurred but not yet paid for by a business.

A:Balance sheet: A balance sheet is a financial statement that shows a company's assets, liabilities,, Q:Rochester, Incorporated purchased cameras from a Japanese company at a price of 4.9 million yenOn, A:When a company conducts transactions in a foreign currency, it is exposed to foreign exchange risk., Q:For this problem, use the fact that the expected value of an event is a probability weighted, A:The expected value of an event is a probability-weighted average, meaning it is the sum of the, Q:Controls that relate to the safeguarding of assets and enhance the accuracy and reliability of the, A:In accounting and business, controls refer to the measures and procedures implemented to ensure that, Q:Compute the amounts of any liability for compensated absences that should be reported on the balance, A:The term "accrued liability" refers to an expense incurred but not yet paid for by a business.  WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. Donec aliquet. E) Materials Inventory.

WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. Donec aliquet. E) Materials Inventory. Work in process, P160,000 dr.

First week only $4.99! had the following balances: The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods Jack and, A:Ordinary income includes all those incomes that are taxable at ordinary rates such as salary,, Q:Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] Finished goods, P96,000 dr. Work in process, P160,000 dr. Prepare the journal entries reflecting the completion of Jobs 13-280 and 13-282 and the sale of Job 13-280 on account. The bonds are, A:Bonds are the debt securities that a corporation issues to raise money. Manufacturing overhead control: P20,000 cr.Cost of goods sold 384,000 dr.Finished goods 96,000 dr.Work in process 160,000 dr.Raw materials 160,000 dr.Case 1: Any under -or overapplied overhead is considered immaterial. Nam lacinia pulvinar tortor nec facilisis. In, Q:The payroll records of Brownlee Company provided the following Information for the weekly pay period, A:Employment Insurance(EI) Deduction:

First week only $4.99! had the following balances: The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods Jack and, A:Ordinary income includes all those incomes that are taxable at ordinary rates such as salary,, Q:Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] Finished goods, P96,000 dr. Work in process, P160,000 dr. Prepare the journal entries reflecting the completion of Jobs 13-280 and 13-282 and the sale of Job 13-280 on account. The bonds are, A:Bonds are the debt securities that a corporation issues to raise money. Manufacturing overhead control: P20,000 cr.Cost of goods sold 384,000 dr.Finished goods 96,000 dr.Work in process 160,000 dr.Raw materials 160,000 dr.Case 1: Any under -or overapplied overhead is considered immaterial. Nam lacinia pulvinar tortor nec facilisis. In, Q:The payroll records of Brownlee Company provided the following Information for the weekly pay period, A:Employment Insurance(EI) Deduction:

Recent Shootings In Williamsport, Pa, Articles J